CONTENTS

CHAPTER I - COMMON PROVISIONS

CHAPTER II - ACTS SUBJECT TO PRIOR AUTHORISATION

CHAPTER III - ACTS NOT SUBJECT TO PRIOR AUTHORISATION

CHAPTER IV - ELECTION, APPOINTMENT, WITHDRAWAL AND RESIGNATION

CHAPTER V - REGULATORY SANDBOX

CHAPTER VI - BUSINESS PLAN

CHAPTER VII - FINAL PROVISIONS

ANNEX I - DOCUMENTATION APPLICABLE TO SUPERVISED COMPANIES

ANNEX II - DOCUMENTATION APPLICABLE TO FOREIGN REINSURERS

ANNEX III - DOCUMENTATION APPLICABLE TO REINSURANCE BROKERS

ANNEX IV - DOCUMENTATION APPLICABLE TO ELECTION, APPOINTMENT, WITHDRAWAL AND RESIGNATION PROCEDURES

ANNEX V - DOCUMENTATION APPLICABLE TO REGULATORY SANDBOX PROCESSES

SUSEP CIRCULAR NO. 700 OF 4 APRIL 2024 (*)

Establishing procedures related to the instruction of Susep's authorisation processes for operation, the start of operations in the country, the exercise of positions in statutory or contractual bodies, the payment of capital, the conversion of the temporary authorisation of companies participating in the Regulatory Sandbox and the conditions of the corporate control structure of supervised companies, reinsurance brokers, foreign reinsurers and representative offices of admitted reinsurers.

THE SUPERINTENDENT OF THE PRIVATE INSURANCE SUPERINTENDENCY - SUSEP, using the powers conferred on him by the art. 36, subitem "b", of the Decree-Law no. 73, of 21 November 1966; the art. 3, par. 2, of the Decree-Law no. 261, of 28 February 1967; the arts. 5, 73 and 74 of the Complementary Law no. 109, of 29 May 2001 and the art. 3, sole paragraph, of the Complementary Law no. 126, of 15 January 2007; considering the provisions in the art. 36, subitem "a", and in the arts. 74, 75, 76 and 77 of the Decree-Law 73, of 1966; in the art. 4 of the Decree-Law 261, of 1967; in the art. 38, items I and IV, and in the art. 39, item I, of Complementary Law 109 of 2001; in the Decree No. 10.139 of 28 November 2019; in the CNSP Resolution No. 422, of 11 November 2021; and what is contained in Susep File No. 15414.634650/2022-82, resolves:

CHAPTER I

COMMON PROVISIONS

Section I

The Object

Art. 1. This Circular regulates:

I - Susep's prior authorisation for the corporate acts provided for in art. 4 of CNSP Resolution 422 of 11 November 2021;

II - approval by Susep of the corporate acts provided for in art. 5 of CNSP Resolution 422 of 2021; and

III - communicating to Susep the corporate acts provided for in art. 6 of CNSP Resolution 422 of 2021.

Sole paragraph. Corporate acts which deliberate solely on matters not subject to authorisation, approval or communication, and which are for any reason submitted to Susep, will be filed without analysis of their merit.

Section II

Definitions

Art. 2. The processes referred to in art. 1 must comply with the rules and definitions of CNSP Resolution 422, of 2021, or any other regulation that may replace it in dealing with the subject, and be:

I - instructed with the documents listed in the Annexes to this Circular, as applicable to the specific case, to the subject and to the procedural stage; and

II - to the General Coordination responsible for licensing at Susep.

Sole paragraph. For the purposes of this Circular, the General Coordination responsible for licensing is considered to be the General Coordination responsible for licensing, authorisations, registration, accreditation and records at Susep.

Section III

Rites and Deadlines

Art. 3. When filing the acts governed by this Circular, the person responsible for conducting the process with Susep must be identified.

Sole paragraph. The function referred to in the heading will be exercised in the supervised companies, in the foreign reinsurers and in the authorised reinsurance brokers, respectively, by the director responsible for relations with Susep, the attorney-in-fact or representative, or the technical manager.

Art. 4. Prior to filing the documents referred to in arts. 13, 15, 28 and 37, interested parties must request the technical presentation provided for in arts. 12 and 40 of CNSP Resolution 422 of 2021, the date and time of which will be set by the General Coordination responsible for licensing.

Art. 5. In acts subject to the prior authorisation referred to in art. 4 of CNSP Resolution no. 422 of 2021, interested parties must carry out the necessary acts within 90 (ninety) days of their authorisation.

Art. 6. Corporate acts subject to approval by Susep or communication, as referred to in arts. 5 and 6 of CNSP Resolution 422 of 2021 must be filed with Susep within 30 (thirty) days of their realisation, except in the case of ordinary liquidation, when the deadline for submission will be 5 (five) days after realisation.

Sole paragraph. The corporate acts of foreign reinsurers and the representative offices of admitted reinsurers subject to approval by Susep or communication may be filed with Susep within 60 (sixty) days of their realisation, unless otherwise specified.

Art. 7. Requests to extend the deadlines referred to in this Circular must be duly substantiated and accompanied by supporting documentation, which will be assessed, as appropriate, by the Coordination Office responsible.

Sole paragraph. The provisions of the heading do not apply to cases subject to administrative sanctions, under the terms of specific regulations.

Art. 8. Supervised companies, foreign reinsurers and reinsurance brokers must keep their registration data with Susep up to date, taking into account the month of the change, informing them in the manner and within the timeframe established by the specific regulations, regardless of the filing of a process with Susep.

Section IV

Documentation

Art. 9. In addition to the specific documents for each act, all the processes provided for in this Circular must be initiated by:

I - a request signed by a representative of the organisation;

II - a list of all the entity's processes relating to items I, II and III of article 1, which have not yet been concluded at Susep; and

III - a list of the documents forwarded (checklist).

Paragraph 1. The provisions of this article also apply to requests to fulfil requirements and to supplement procedural instructions.

Paragraph 2. The documentation relating to the acts referred to in this Circular must be instructed individually and their identification must be included in the checklist referred to in item III, in the order in which they will be presented in the process.

Art. 10. The General Coordination responsible for licensing will publish the models of the applications, declarations and forms required by this Circular, whenever necessary, on Susep's website.

Paragraph 1. The documents submitted must be signed by the administrators or directors who have representation in the articles of association or bylaws, or by the attorney-in-fact or representative in the case of a foreign reinsurer.

Paragraph 2. In cases where the models referred to in the heading are already included in the Electronic Information System - SEI, all the fields requested must be duly completed.

Art. 11. All documentation from another country must be duly consularised, except for documents from countries with which Brazil has signed an international agreement, and must be accompanied, when written in another language, by a translation into Portuguese, carried out by a sworn public translator, in accordance with current legislation, unless Susep expressly states otherwise.

Paragraph 1. The notarisation must refer to the veracity of the document and/or the signature of the person responsible for issuing it.

Paragraph 2. In the instruction of the processes referred to in art. 4 of CNSP Resolution 422 of 2021, a translation into Portuguese validated by the entity's legal representative will be accepted for the purposes of complying with the provisions of the heading.

Paragraph 3. In the event referred to in par. 2, the corresponding translation, carried out by a sworn public translator, must be presented in the respective process of homologation of the previously authorised corporate act.

Art. 12. Susep, when examining requests formalised by supervised companies, foreign reinsurers or reinsurance brokers, may request any additional documents and information it deems necessary.

CHAPTER II

ACTS SUBJECT TO PRIOR AUTHORISATION

Section I

Authorisation for the Supervised Companies to Operate

Art. 13. Applications for prior authorisation to operate must be accompanied by documents 1 to 9 and 11 to 26 of Annex I, where applicable.

Paragraph 1. For the purposes of this Circular, an extension of the geographical area of operation or a change in the corporate purpose is also considered authorisation to operate.

Paragraph 2. Supervised companies must inform, in the application referred to in item I of art. 9, their classification in one of the segments referred to in art. 4 of CNSP Resolution 388, of 8 September 2020, or any other regulation that may replace it in dealing with the issue.

Art. 14. Once prior authorisation has been obtained, supervised companies must submit a request for approval of the acts authorising them to operate, accompanied by documents 10, and 31 to 41 of Annex I.

Section II

The Control Structure of the Supervised Companies

Art. 15. Applications for prior authorisation to change corporate control must be accompanied by documents 1, 7 to 9 and 11 to 27 of Annex I.

Art. 16. In cases where there is a shareholders' or quota holders' agreement, this must be submitted to Susep in good time, as well as the respective amendments, in which case there must be a clause stating that the agreement takes precedence over any other agreement not submitted to Susep.

Art. 17. Applications for approval of changes in corporate control must be accompanied by documents 10, 31, 32, 36, 42 and 43 of Annex I.

Section III

Other Corporate Acts of the Supervised Companies

Art. 18. Requests for prior authorisation for the spin-off, merger or incorporation of supervised companies must be accompanied by documents 17, and 27 to 29 of Annex I.

Art. 19. Applications for approval of the spin-off, merger or incorporation of supervised companies must be accompanied by documents 31, 37 to 41 and 44 to 46 of Annex I.

Art. 20. Applications for prior authorisation to reduce share capital must be accompanied by document 17 of Annex I.

Art. 21. Applications for approval to reduce share capital must be accompanied by documents 31, 37 to 41, and 47 of Annex I.

Art. 22. Requests for prior authorisation to cancel authorisation to operate must be accompanied by documents 10 and 30 of Annex I, where applicable.

Sole paragraph. For the purposes of this Circular, a reduction in the geographical area of operation or a change in the corporate purpose is also considered to be cancellation of the authorization to operate.

Art. 23. Requests for approval of the cancellation of authorisation to operate must be accompanied by documents 10, 31, and 37 to 41 of Annex I.

Art. 24. After examining the documents pertaining to the act subject to prior authorisation, the General Coordination responsible for licensing may summon interested parties to a technical interview, when a date, time and place will be set.

Paragraph 1. In the technical interview referred to in the heading, the members of the control group:

I - may be questioned on any topic related to the project proposal or the applicant group; and

II - may not be replaced by proxies or representatives.

Paragraph 2. In the case of the incorporation of a company in the country to be controlled by a legal entity based abroad, the General Coordination responsible for licensing may allow the controlling shareholder or members of the controlling group to be represented at the technical interview by an attorney-in-fact with specific powers and who has the necessary knowledge for the interview, especially about the controlling shareholder, the company's controlling group and holders of qualifying holdings.

Paragraph 3. After the technical interview, the General Coordination responsible for licensing will express its opinion on the suitability of the project.

Paragraph 4. In the event of the project being deemed unsuitable, interested parties will be notified of the rejection of the application by the General Coordination responsible for licensing and may, within 30 (thirty) days of receiving the notification, appeal against the decision to the relevant Board.

CHAPTER III

ACTS NOT SUBJECT TO PRIOR AUTHORISATION

Section I

Acts Subject to Susep Approval

Subsection I

Corporate Acts of the Supervised Companies

Art. 25. Requests for approval of acts of acquisition or expansion of a qualifying holding must be accompanied by documents 18 to 27, 31, 36, 43 and 47 of Annex I.

Art. 26. Requests for approval of share capital increases must be accompanied by documents 31, 33 to 41, 47 to 49, 51 and 52 of Annex I.

Paragraph 1. Susep may waive the requirement to submit document 51 of Annex I when the subscribing shareholder is a supervised company or a publicly traded company.

Paragraph 2. Susep may waive the requirement to prove the origin of the funds provided for in document 36 of Annex I, in capital increase acts when the amount paid in directly or indirectly by the subscriber is less than R$ 50,000.00 (fifty thousand reais).

Paragraph 3. The exemption provided for in the previous paragraph does not exempt the supervised company from keeping supporting documentation on the origin of the funds for any request by Susep.

Art. 27. Requests for approval of acts amending the bylaws, in all their types, must be accompanied by documents 31, 37 to 41, and 50 of Annex I.

Subsection II

Acts Relating to the Registration of Foreign Reinsurers

Art. 28. The registration of foreign reinsurers must be accompanied by documents 1 to 12 of Annex II.

Paragraph 1. In addition to the documents requested in the heading, the admitted reinsurer must submit documents 13 to 15 of Annex II.

Paragraph 2. Document 27 of Annex II must be sent in cases where its public issuance is not possible.

Paragraph 3. In the case of registration of a foreign reinsurer specialising in nuclear risks, documentation must be submitted, without prejudice to the other requirements established by this Circular, proving that the interested parties operate in the form of a consortium in the country of origin, if applicable.

Paragraph 4. For cases in which a solvency rating report is submitted for the economic group to which the foreign reinsurer belongs, in which it is not possible to identify its individual rating, a letter issued by the rating agency containing the individual rating information must be provided in addition.

Paragraph 5. In the event of a change in the domicile of the foreign reinsurer, the period of activity at the previous parent company may be considered jointly, for the purposes of complying with item II of art. 26 of CNSP Resolution 422 of 2021.

Art. 29. Once the documents referred to in art. 28 have been analysed, the admitted reinsurer must submit documents 16 and 17 of Annex II within 60 (sixty) days.

Paragraph 1. In the event that the admitted reinsurer uses its own office, documents 18 and 19 of Annex II must be submitted in addition, as the case may be.

Paragraph 2. Document 18 of Annex II must expressly mention the name of the representative and their substitute.

Paragraph 3. Admitted reinsurers who have their own representative office may request a change to an outsourced office by submitting documents 7 to 11, 14, and 15 of Annex II.

Paragraph 4. All the requirements applicable to own offices apply to outsourced representative offices, including those relating to the implementation and maintenance of an internal control system.

Paragraph 5. In the event that the admitted reinsurer uses an outsourced office, document 29 of Annex II must be submitted in addition.

Art. 30. For the purposes of registration as a foreign reinsurer under the terms of this Circular, Lloyd's members will be considered a single entity, and must also submit a list of syndicates and members authorised to carry out operations in the country, updating it quarterly, with Lloyd's assuming responsibility for allocating the resources of its members held in trust at Lloyd's and managing the Central Fund in order to ensure the solvency of its members.

Sole paragraph. The Central Fund held by Lloyd's may be accepted, as the assets required by item I of article 28 of CNSP Resolution 422 of 2021, for registration and maintenance purposes.

Art. 31. Information on the representative office, whether in-house or outsourced, must be communicated to Susep within 60 (sixty) days, whenever there is a change.

Sole paragraph. In the event of an increase in the representative office's capital, document 17 of Annex II must also be submitted.

Art. 32. It is forbidden for the same foreign reinsurer to register simultaneously as an eventual and admitted reinsurer.

Paragraph 1. The foreign reinsurer may request that its registration be changed to eventual or admitted, provided that it complies with the provisions of this Circular.

Paragraph 2. In analysing the requests referred to in par. 1, the documentation sent by the interested party in the registration update process referred to in art. 34 may be used, provided that it refers to the last financial year, in which case additional documentation may be requested in order to prove full compliance with the requirements set out in this Circular.

Subsection III

Other Acts of Foreign Reinsurers

Art. 33. The request to include a new insurance branch or group of branches in the authorisation must be accompanied by documents 1, 5 and 6 of Annex II.

Art. 34. Periodic registration update processes must be accompanied by documents 1 (items a and c), 2 to 4, 6 and 12 of Annex II.

Paragraph 1. Registration updates must be submitted within 180 (one hundred and eighty) days of the end of the financial year of each year in the country of origin, containing the full documentation referred to in the heading.

Paragraph 2. In addition, admitted reinsurers must submit document 20 of Annex II.

Paragraph 3. Foreign reinsurers who have been registered in the current financial year are exempt from the registration update process referred to in the heading, provided that the documentation submitted in the registration process refers to the last financial year.

Paragraph 4. For the purposes of complying with item II of art. 26 of CNSP Resolution 422 of 2021, only statements issued by the insurance or reinsurance supervisory body of the country of origin that objectively inform the branches in which the foreign reinsurer has effectively operated in the last 5 (five) years will be accepted.

Paragraph 5. The bank statements of the foreign currency account linked to Susep or of investments in financial assets, referring to financial transactions in the last financial year presented in the periodic registration updates must bear the bank's letterhead and the signature of the manager responsible for issuing them.

Art. 35. Requests for changes of attorney-in-fact must be accompanied by documents 6 to 9 and 11 of Annex II.

Art. 36. Requests for cancellation of registration must be accompanied by documents 6 and 24 to 26 of Annex II.

Sole paragraph. For the purposes of releasing the amount deposited in a foreign currency account in Brazil or invested in financial assets, the admitted reinsurer must present documentation proving that it does not have private passive operations with Brazilian cedents.

Subsection IV

Corporate Acts of Reinsurance Brokers

Art. 37. Applications for authorisation for reinsurance brokers to operate must be accompanied by documents 1 to 14 of Annex III, where applicable.

Art. 38. Reinsurance brokers set up, as joint stock companies must submit documents 30 to 33 of Annex III with their processes.

Art. 39. The articles of association, bylaws or constitutive act of reinsurance brokers must include:

I - the company name, under the terms of art. 14 of CNSP Resolution 422 of 2021;

II - the corporate purpose, under the terms of art. 13 of CNSP Resolution 422 of 2021; and

III - the technical manager, under the terms of item V of article 21 of CNSP Resolution 422 of 2021.

Sole paragraph. The technical manager referred to in item III must be an insurance broker authorised to operate in all classes of insurance and have their registration active with Susep.

Art. 40. The professional liability insurance policy must be submitted to Susep in a process drawn up in accordance with document 34 of Annex III, within 30 (thirty) days of its contracting or renewal, under penalty of suspension of the authorisation to operate.

Paragraph 1. The professional liability insurance policy in force must be accompanied by proof of payment of the overdue premium instalment, and the document relating to the contracting proposal or quotation will not be accepted.

Paragraph 2. Proof of payment of the outstanding instalments of the insurance premium referred to in the heading must be kept at Susep's disposal in the event of any inspection.

Art. 41. Requests for approval to cancel authorisation to operate must be accompanied by documents 1 to 3, 7, and 21 to 23 of Annex III.

Sole paragraph. For the purpose of this Circular, cancellation of authorisation to operate is also considered to be a change in the company's corporate purpose that de-characterises the activity of reinsurance brokerage.

Section II

Acts Subject to Communication

Subsection I

Acts of Foreign Reinsurers

Art. 42. Communications of changes to the company name must be accompanied by documents 6 and 21 of Annex II.

Art. 43. Communications of changes to the attorney-in-fact's details must be accompanied by documents 6 to 11 of Annex II, where applicable.

Art. 44. Communications of change of registered office or country of origin must be accompanied by documents 1, issued by the new registered office, and 6 of Annex II.

Art. 45. Communications of mergers, spin-offs or incorporations of foreign reinsurers registered with Susep must be accompanied by documents 1, 5, 6 and 23 of Annex II.

Paragraph 1. In cases where the company resulting from the operation is not a previously registered foreign reinsurer, a new authorisation must be requested.

Paragraph 2. In the event referred to in par. 1, the time of effective operation of the predecessor companies may be taken into account, for the purposes of complying with item II of art. 26 of CNSP Resolution 422 of 2021.

Art. 46. The communication of acts relating to the representative office must be accompanied by documents 6, 18 and 28 of Annex II.

Sole paragraph. In the event of an increase in the representative office's capital, document 17 of Annex II must also be submitted.

Subsection II

Reinsurance Brokerage Acts

Art. 47. Communications of changes to the company name must be accompanied by documents 1 to 3, and 28 and 29 of Annex III.

Art. 48. Communications of transfer of corporate control must be accompanied by documents 1 to 15 of Annex III.

Art. 49. Communications of merger, spin-off or incorporation must be accompanied by documents 1 to 3 and 16 to 19 of Annex III.

Art. 50. Communications of acquisition or expansion of a qualifying holding must be accompanied by documents 1 to 3, 6, 8 to 15, and 20 of Annex III.

Art. 51. Communications of share capital increase or reduction must be accompanied by documents 1 to 3, 6, 24 to 27, and 29 of Annex III.

Art. 52. The communication of the acts of transformation of the legal form must be instructed with documents 1 to 3, and 28 of Annex III.

Art. 53. Communication of any amendment to the bylaws, articles of association or articles of incorporation, in all their types, must be accompanied by documents 1 to 3, and 29 of Annex III.

CHAPTER IV

ELECTION, APPOINTMENT, WITHDRAWAL AND RESIGNATION

Art. 54. Supervised companies must assign individual responsibility to a director, by area of activity, which may be exercised cumulatively with other duties and functions, provided that there is no conflict of interest and that good governance practices recommend it.

Paragraph 1. The director designated as responsible for relations with Susep shall be responsible for the relationship with the Authority, providing, alone or jointly with other directors, the information requested by it.

Paragraph 2. The director designated as the administrative-financial officer shall be responsible for supervising administrative and economic-financial activities, including compliance with all corporate legislation and that applicable to the fulfilment of the respective corporate objectives.

Paragraph 3. In the event of an election, or a change in the composition of the board of directors or in the specific duties assigned to the directors, all positions and duties must be ratified in the respective corporate act.

Paragraph 4. Communications of changes in the appointment of statutory directors must be accompanied within 30 (thirty) days by the documents set out in Annex IV, where applicable.

Paragraph 5. - In the event of the accumulation of duties or functions referred to in the heading, the supervised company must demonstrate the exclusion of the hypothesis of conflict of interest and compliance with good governance practices.

Art. 55. The enquiries referred to in par. 1 of art. 43 of CNSP Resolution 422 of 2021 must be accompanied by documents 1, 6, 7, 8, 9 and 12 of Annex IV, for supervised companies, the representative offices of admitted reinsurers and reinsurance brokers.

Paragraph 1. If the elected or appointed person falls into any of the situations provided for in par. 1 of art. 44 of CNSP Resolution 422 of 2021, this circumstance must be informed in the consultation referred to in the heading, which must be accompanied by documents that make it possible to ascertain the nature and stage of the occurrences reported.

Paragraph 2. For the purposes of proving compliance with the technical training requirements set out in art. 45 of CNSP Resolution 422 of 2021, the registration forms and CVs of those elected must specify the positions or functions held and the period of office.

Art. 56. The procedures for ratifying the election for the exercise of positions in statutory and contractual bodies and for dismissal must be instructed within a period of up to 30 (thirty) days, counted from the date of their realisation, accompanied by the following documents, as the case may be, without prejudice to the other requirements set out in CNSP Resolution 422 of 2021:

I - 1 to 5, 10, 11, 13 to 16, 23 and 24 of Annex IV, for supervised companies;

II - 1, 10, 17 to 19, and 23 of Annex IV, for the representative offices of admitted reinsurers; and

III - 1, 3, 10, 13, 20, 21 and 23 of Annex IV, for reinsurance brokers.

Sole paragraph. In the case of representative offices of admitted reinsurers, the processes referred to in the heading must be instructed within 60 (sixty) days from the date of their realisation.

Art. 57. Communications of resignation or withdrawal of statutory or contractual positions in supervised companies and reinsurance brokers must be submitted to Susep within 30 (thirty) days.

Paragraph 1. In the processes referred to in the heading, document 22 of Annex IV must be submitted, together with the measures that will be adopted by the organisation in the event of a breach of the legislation or bylaws resulting from the resignation or withdrawal.

Paragraph 2. In the event of a director being appointed to a specific role, the redistribution of roles among the remaining directors must be presented, which must be ratified in the first corporate act that takes place after the resignation or withdrawal.

Paragraph 3. In the event of the resignation or withdrawal of the representative of the admitted reinsurer's representative office provided for in the heading, a new representative must be appointed within a maximum of 30 (thirty) days.

Paragraph 4. Communications of withdrawal of statutory or contractual office holders from the representative offices of admitted reinsurers must be submitted to Susep within 60 (sixty) days.

Paragraph 5. The provisions of Chapter IV shall apply, where applicable, to substitutes for representatives of the representative office of admitted reinsurers.

CHAPTER V

REGULATORY SANDBOX

Art. 58. Applications for prior authorisation to convert temporary operating authorisation into definitive authorisation from participants in the experimental regulatory environment (Regulatory Sandbox) must be accompanied by documents 1 and 2 of Annex V.

Art. 59. Applications for approval to convert temporary operating authorisation into definitive authorisation from participants in the experimental regulatory environment (Regulatory Sandbox) must be accompanied by documents 3 to 8 of Annex V.

Sole paragraph. In the corporate act that decides to convert the insurance company participating exclusively in an experimental regulatory environment (Regulatory Sandbox) into a supervised company, the election of directors, if applicable, and the designation of the corresponding functions must be carried out.

Art. 60. Applications for amendments to the articles of association, election of members of statutory bodies, corporate reorganisation, increase or reduction of capital of participants in the experimental regulatory environment (Regulatory Sandbox) must comply with the requirements and procedures for incorporation, authorisation to operate, registration, changes of control, corporate reorganisations and conditions for holding office in statutory or contractual bodies of insurance companies governed by this Circular.

CHAPTER VI

BUSINESS PLAN

Art. 61. The business plan referred to in document 17 of Annex I, must contain planning for a period of 3 (three) years and present at least the following elements:

I - the supervised company's strategic objectives;

II - details of the organisational structure, compatible with its business plan and with clear determination of the responsibilities assigned to the various bodies and/or areas of the supervised company;

III - a description of the economic scenario in which the supervised company expects to do business;

IV - financial projections, showing the development of assets over the period, identifying the sources of funds and/or income that will make this development possible;

V - investment policy;

VI - cyber security and data protection policy;

VII - branches in which the supervised company intends to operate and their expected share of its total revenue;

VIII - reinsurance management;

IX - initial investment and estimated return;

X - risk identification;

XI - deadline for the start of activities, following publication of the authorisation to operate;

XII - compliance and risk management guidelines;

XIII - code of conduct with regard to customer relations; and

XIV - sustainability strategy.

Paragraph 1. The description of the economic scenario, provided for in item III of the heading, must include the following parameters:

I - interest rate, projected for the following cases:

a) the economy's base rate;

b) rate of return on assets; and

c) rate of return on liabilities.

II - projected inflation; and

III - projected rate of economic expansion, taking into account the economic performance indices most closely related to expected sales revenues.

Paragraph 2. The financial projections referred to in item IV must be drawn up at quarterly intervals, for the scenario referred to in item III of the main section, with the items listed below:

I - balance sheet and income statement for the year;

II - cash flow expressed in reais, with the respective activities segregated into operating, investment, financing and final balance; and

III - a capital requirement study, comparing the capital required to operate with the adjusted net equity.

Paragraph 3. Supervised companies must prepare or update their business plans at least annually, or whenever there is a significant change in their strategic planning, so that Susep may, at any time, request the business plan containing the information referred to in items I to XIV of the heading.

CHAPTER VII

FINAL PROVISIONS

Art. 62. Insurance companies and open complementary pension fund entities may operate in microinsurance.

Art. 63. The rules on authorisation to operate and the corporate changes derived from them, applicable to other insurance companies, apply to microinsurance companies, as well as the hypothesis of suspension and cancellation of authorisation to operate provided for in the specific rule.

Art. 64. The procedural instruction of the corporate acts referred to in art. 1 in disagreement with this Circular may result in the closure of the process by the Coordination responsible.

Art. 65. The following are hereby repealed:

I - Susep Circular 234 of 28 August 2003;

II - Susep Circular 311 of 27 December 2005;

III - Susep Circular 439 of 27 June 2012;

IV - Susep Circular no. 526, of 25 February 2016;

V - Susep Circular 527 of 25 February 2016;

VI - Susep Circular 528 of 25 February 2016;

VII - Susep Circular 529 of 25 February 2016;

VIII - Susep Circular 589 of 5 July 2019;

IX - Susep Circular no. 606, of 19 June 2020;

X - Susep Instruction no. 42, of 25 July 2006;

XI - Circular Letter no. 2/Susep/Dirat/Cgrat, of 19 March 2010;

XII - Circular Letter no. 5/Susep/Dirat/Cgrat, of 15 December 2011;

XIII -- Circular Letter no. 6/Susep/Dirat/Cgrat, of 15 December 2011;

XIV - Circular Letter no. 7/Susep/Dirat/Cgrat, of 20 December 2011;

XV - Circular Letter no. 8/Susep/Dirat/Cgrat, of 10 April 2013;

XVI - Circular Letter no. 9/Susep/Dirat/Cgrat, of 28 March 2014;

XVII - Circular Letter no. 10/Susep/Dirat/Cgrat, of 30 June 2014;

XVIII - Circular Letter no. 11/Susep/Dirat/Cgrat, of 25 September 2014;

XIX - Circular Letter no. 1/Susep/Cgrat, of 29 February 2016; and

XX - Electronic Circular Letter No. 1/2019/Susep/Diretoria Tecnica 1/CGRAL, of 28 May 2019.

Art. 66. This Circular comes into force on 1 August 2024, except for articles 34, 54, and 58 to 60, which come into force on the date of its publication.

ALESSANDRO SERAFIN OCTAVIAN LUIS

(Official Gazette DOU of 15 April 2024 - pages 98 to 103 - Section 1)

ANNEX I

DOCUMENTATION APPLICABLE TO SUPERVISED COMPANIES

1 - Identification of the members of the organising group.

2 - Valuation report on the assets of the not-for-profit open complementary pension fund (EAPC) in transformation.

3 - Portion of the assets of the not-for-profit EAPC in transformation representing the company's equity, if any.

4 - Actuarial valuation of the technical provisions of the not-for-profit EAPC in transformation.

5 - A statement of the shortfall in the assets of the not-for-profit EAPC in transformation and how it is covered, if applicable.

6 - Calculation of the criteria for apportioning the company's assets among the members, for the purposes of distributing the shares resulting from the transformation of the not-for-profit EAPC into a joint-stock company.

7 - A complete organisational chart of the economic group, identifying all the legal entities with their registration number in the National Register of Legal Entities (CNPJ), or, if foreign, with the name of the country where the parent company is located and the respective percentages of voting and total capital held, or a declaration that the supervised company does not belong to an economic group.

8 - Indication of the form in which the supervised company's corporate control will be exercised, if any.

9 - Identification of the origin of the resources to be used in the operation.

10 - Full pages of copies of the newspapers in which the statement of purpose was published, published on two dates, in a newspaper with a wide circulation in the localities of the headquarters of the supervised company and the headquarters or domicile of the controlling shareholders.

11 - Financial statements for the last two financial years of the prospective direct or indirect controlling legal entities, if any, except in the case of an entity authorised to operate by Susep, audited by an independent auditor duly registered with Brazil's Securities and Exchange Commission (CVM) or an equivalent document in the case of a legal entity based abroad.

12 - Annual income tax returns for prospective natural persons who are direct or indirect controlling shareholders, if any, for the last two financial years, with proof of submission to the Inland Revenue authority of Brazil (SRF) or an equivalent document, in the case of foreign residents, showing the annual income earned and a list of the natural person's assets, rights and encumbrances, with their respective value.

13 - Where applicable, under the terms of article 16, a draft shareholders' or quotaholders' agreement involving all levels of shareholding, which must include a clause that takes precedence over any other agreement not submitted to Susep for appraisal, or a declaration that it does not exist.

14 - A usufruct agreement relating to the shareholdings of the prospective controlling shareholders, if any, involving all levels of shareholding or a declaration that there is no such agreement.

15 - Indication of other investments held in Brazil or made with other Brazilian companies by the prospective controlling shareholders, if any, direct or indirect, or a declaration that there are no such investments.

16 - Proof of the independent auditor's good standing with the CVM.

17 - A business plan, in the form defined by this Circular, or a summary of the changes resulting from the authorisation sought.

18 - Identification of the members of the controlling group and holders of qualifying holdings, if any, with their respective shareholdings.

19 - Registration form, according to the model published by Susep.

20 - Declaration of compliance with the requirements of art. 44 of CNSP Resolution 422 of 2021.

21 - Authorisation signed by the controlling shareholders and holders of qualifying holdings, if any, to the Inland Revenue authority of Brazil (SRF), to provide Susep with the Annual Income Tax Adjustment Statements of the natural person or the Economic-Fiscal Information Statements of the legal entity, as the case may be, relating to the last two financial years, for exclusive use in the respective authorisation process.

22 - Authorisation to Susep signed by the controlling shareholders and holders of qualifying holdings, if any, to access information about them in any public or private registration and information system, including judicial or administrative proceedings and police investigations, for exclusive use in the respective authorisation process.

23 - Organisational chart of the prospective controlling shareholder, if any, and a statement of the composition of its capital and the legal entities that participate in it directly or indirectly.

24 - Articles of incorporation of prospective direct and indirect controlling shareholders, if any.

25 - No objection from the foreign supervisory authority in the case of a person resident or based abroad.

26 - Statement of capital sufficiency, in the case of an entity subject to a minimum capital requirement.

27 - Statement of the economic justification for goodwill or negative goodwill.

28 - Simulation of the balance sheet of the entities involved, before and after the spin-off, merger or incorporation.

29 - Complete organisational charts of the economic groups involved, before and after the spin-off, merger or incorporation.

30 - Declaration that all passive operations that are the property of the entity or portfolio whose cancellation of operating authorisation is sought have been settled, or information on the measures that will be adopted in relation to any obligations that are the property of an entity supervised by Susep and that are pending settlement.

31 - Statement of corporate acts under consideration by Susep.

32 - Proof of the bank deposit of the amount relating to the payment of the initial share capital, in accordance with current legislation.

33 - Subscription list or bulletin.

34 - Proof of registration of the issue of shares with the CVM, in the case of a company incorporated by public subscription or transformation into a public company.

35 - Asset appraisal reports, in accordance with the provisions of art. 8 of Law 6.404 of 15 December 1976.

36 - Proof of the origin and respective financial movement of the funds used in the operation, up until their contribution to the company.

37 - List of shareholders, associates or counsellors present at the act, with a declaration that, in the case of those represented, the determinations established in art. 126 of Law no. 6,404 of 1976 have been observed.

38 - A complete list of shareholders, associates or board members on the date of the act. In the case of shareholders, those who hold 15% (fifteen per cent) or more of the share capital must be informed, totalling the number of shares representing the share capital, with the expression "other shareholders" for those with a holding of less than 15% (fifteen per cent).

39 - Proof of invitation to the conclave, in accordance with the law.

40 - Minutes of the conclave.

41 - Declaration that the legal provisions regarding the quorum for the installation and resolution of the assembly or meeting held have been faithfully observed.

42 - Purchase and sale agreement or equivalent instrument, which must include a clause stipulating that the deal is conditional on its approval by Susep.

43 - Share transfer deed or contractual amendment showing the transfer of shares.

44 - Corporate acts of the entities involved, which decided on the merger, spin-off or incorporation.

45 - Minutes of the debenture holders' meeting that approved the merger, spin-off or incorporation or a document proving that the debenture holders' rights have been ensured, when the company involved is an issuer of outstanding debentures.

46 - Protocol and justification and the appraisal reports of the appointed experts, if they have not been transcribed in the articles of association.

47 - Organisational chart of the entity, before and after the change in share capital, containing the percentage of shares held by each shareholder, up to a minimum of 15% (fifteen per cent) of the share capital, totalling the percentage of shares in the capital with the expression "other shareholders" for those with a shareholding of less than 15% (fifteen per cent), and highlighting the participation of foreigners, if any. If the shareholder is a legal entity, its shareholders should also be informed, up to the level of natural persons, when possible.

48 - Proof of deposit of the amount relating to the payment of the share capital increase in a bank account held by the organisation.

49 - Publication of notice to shareholders to exercise preference rights.

50 - Comparative table between the bylaws amended in the act whose approval is sought and the last one previously submitted to Susep.

51 - Financial statements of the subscribing shareholder for the last financial year.

52 - Declaratory registration of foreign direct investment in Sisbacen of the Central Bank of Brazil.

ANNEX II

DOCUMENTATION APPLICABLE TO FOREIGN REINSURERS

1 - A document issued by the insurance or reinsurance supervisory body in the country of origin, stating that:

a) the reinsurer is constituted under the laws of its country of origin to underwrite local and international reinsurance in the classes in which it intends to operate in Brazil;

b) the reinsurer has commenced such operations in the country of origin for more than 5 (five) years; and

c) the reinsurer is in good standing with the supervisory body.

2 - Balance sheet and income statements for the last financial year, with the respective independent auditors' reports.

3 - A certificate from the independent auditors, with information on the value of the foreign reinsurer's individual net worth ascertained in the last financial year, which must be higher than the minimum established by the National Private Insurance Council of Brazil (CNSP).

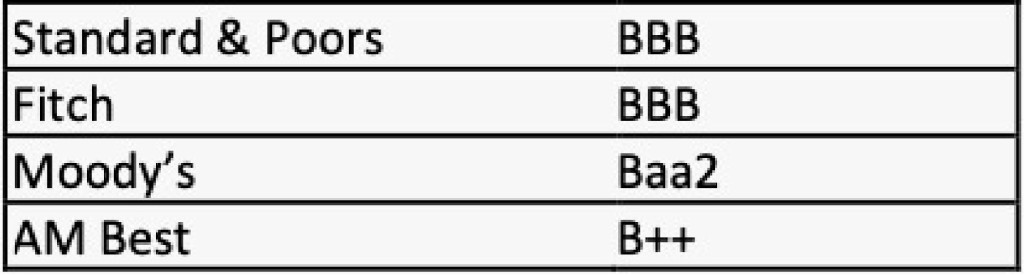

4 - A full solvency rating report for the foreign reinsurer, which includes the results of the last financial year and explicitly mentions the date of its calculation, issued by one of the rating agencies listed below, with the following minimum levels:

5 - Correlation of the groups/branches in which the reinsurer intends to operate in Brazil, under the terms of Susep Circular no. 535, of 28 April 2016, or any other that may replace it in dealing with the issue.

6 - A power of attorney appointing a natural person domiciled in Brazil with special powers to receive summonses, notices and other communications. This power of attorney must contain clear and objective information about the possibility of the appointed attorney sub-establishing the powers conferred on them by the parent company and about the period of validity, even if it is indefinite.

7 - Declaration signed by the attorney-in-fact stating their qualifications, full business address, telephone number and e-mail address.

8 - Registration form, according to the model published by Susep.

9- Declaration of compliance with the requirements of art. 44 of CNSP Resolution 422 of 2021.

10- Declaration of compliance with the requirements of article 45 of CNSP Resolution 422 of 2021.

11 - Authorisation for Susep to access information about them contained in any public or private registration and information system, including judicial or administrative processes and procedures, for exclusive use in the respective authorisation process.

12 - A declaration signed by the attorney-in-fact stating the full address, telephone number, contact person and e-mail address of the parent company.

13 - A document issued by a bank authorised to operate in foreign exchange in Brazil, duly signed by the manager of the financial institution, certifying that the opening of a foreign currency account in Brazil has been requested and approved, linked to Susep, if applicable.

14 - A decision by the parent company appointing a representative in Brazil and his/her substitute, under the terms established by the National Private Insurance Council.

15 - A decision by the parent company authorising the opening of its own office or the appointment of an outsourced office for representation in the country.

16 - Proof of the minimum balance of the account linked to Susep, or of the investment in financial assets, in the amount of:

a) US$ 5,000,000.00 (five million United States dollars), or equivalent in another freely convertible foreign currency, for admitted reinsurers operating in all classes; or

b) US$ 1,000,000.00 (one million United States dollars), or the equivalent in another freely convertible foreign currency, for admitted reinsurers operating only in the personal lines of business.

17 - Proof of the origin and respective financial movement of the funds used in the operation.

18 - Bylaws or articles of association of the representative office.

19 - Publication of the document formalising the authorisation, in the case of a dependency of a foreign company.

20 - Bank statements of the foreign currency account linked to Susep or statements of investments in financial assets, referring to financial transactions in the last financial year.

21 - Documentation issued by the insurance or reinsurance supervisory body in the country of origin or by the relevant registration body, proving a change in company name.

22 - Decision by the parent company to change the name.

23 - Act of resolution of the parent company in which the merger, spin-off or acquisition was decided.

24 - Decision by the parent company to close the operation in Brazil.

25 - Complete copies of the newspapers in which the statement of purpose was published, published on two dates, in a newspaper with a wide circulation in the localities of the registered office of the representative and the registered office or domicile of the proxies or representatives.

26 - Documentation proving that the foreign reinsurer has no current risks or, alternatively, a plan to discontinue operations.

27 - Certificate of No Debt with the Special Secretariat of the Federal Revenue of Brazil (SRF).

28 - Act of resolution of the parent company in which it was decided to change the representative office.

29 - Declaration signed by the representative of the outsourced representative office, stating that all the requirements applicable to own offices are met, especially those relating to the implementation and maintenance of an internal control system.

ANNEX III

DOCUMENTATION APPLICABLE TO REINSURANCE BROKERS

1 - Articles of association or contractual amendment.

2 - Bylaws and minutes of the relevant meeting.

3 - Memorandum of association or amendment to the memorandum of association.

4 - A complete organisational chart of the economic group, identifying all the legal entities with their registration number in the National Register of Legal Entities (CNPJ), or, if foreign, with the name of the country where the parent company is located and the respective percentages of voting and total capital held, or a declaration that the entity does not belong to an economic group.

5 - Indication of the manner in which corporate control of the entity will be exercised.

6 - Proof of the origin and respective financial movement of the funds used in the operation, until they are transferred to the brokerage firm.

7 - Full pages of copies of the newspapers in which the statement of purpose was published, published on two dates, in a newspaper with a wide circulation in the localities of the parent company of the reinsurance broker and the parent company or domicile of the prospective controlling shareholders or partners.

8 - Identification of the members of the controlling group and holders of qualifying holdings, with their respective shareholdings.

9 - Annual income tax returns of direct or indirect controlling natural persons, or holders of qualifying holdings for the last two financial years, with proof of submission to the Special Secretariat of the Federal Revenue of Brazil (SRF) or equivalent document, in the case of residents abroad, showing the annual income earned and a list of the natural person's assets, rights and encumbrances, with the respective value.

10 - Indication of other investments held in Brazil or made with other Brazilian companies by the direct and indirect controlling shareholders or a declaration that there are no such investments.

11 - Registration form, according to the model published by Susep.

12 - Declaration of compliance with the requirements of art. 44 of CNSP Resolution 422 of 2021.

13 - Express authorisation by all members of the controlling group and by all holders of qualifying holdings to the Special Secretariat of the Federal Revenue Service of Brazil (SRF) to provide Susep with a copy of the declaration of income, assets and rights and debts and encumbrances for the last 2 (two) financial years, for exclusive use in the respective authorisation process.

14 - Express authorisation by all members of the controlling group and all holders of qualifying holdings to Susep to access information about them contained in any public or private registration and information system, including judicial or administrative processes and procedures, for exclusive use in the respective authorisation process.

15 - Share transfer agreement.

16 - Complete organisational charts of the economic groups involved, before and after the spin-off, merger or incorporation.

17 - Corporate acts of the entities involved, which decided on the merger, spin-off or incorporation.

18 - Minutes of the debenture holders' meeting that approved the merger, spin-off or incorporation or a document proving that the debenture holders' rights have been ensured, when the company involved is an issuer of outstanding debentures.

19 - Protocol and justification and the appraisal reports of the appointed experts, if they have not been transcribed in the articles of association.

20 - Organisational chart of the entity, before and after the acquisition or expansion of the qualifying holding, containing the percentage of shares held by each shareholder or partner, up to a minimum of 15% (fifteen per cent) of the share capital, totalling the percentage of shares in the capital with the expression "other shareholders" for those with a holding of less than 15% (fifteen per cent), and highlighting the participation of foreigners, if any. If the shareholder is a legal entity, its shareholders should also be informed, up to the level of natural persons, when possible.

21 - Declaration that all passive operations that are the property of the entity or portfolio whose cancellation of operating authorisation is sought have been settled, or information on the measures that will be adopted in relation to any obligations that are the property of an entity supervised by Susep and that are pending settlement.

22 - Appointment of a partner or person responsible for keeping documents.

23 - Indicating a partner or person responsible for obligations or debts of any kind.

24 - Organisation chart of the entity, before and after the change in share capital, containing the percentage of shares held by each shareholder, up to a minimum of 15% (fifteen percent) of the share capital, totalling the percentage of shares in the capital with the expression "other shareholders" for those with a shareholding of less than 15% (fifteen percent), and highlighting the participation of foreigners, if any. If the shareholder is a legal entity, its shareholders should also be informed, up to the level of natural persons, when possible.

25 - Proof of the bank deposit of the amount relating to the payment of the initial share capital, in accordance with current legislation.

26 - Publication of notice to shareholders to exercise preference rights.

27 - Subscription list or bulletin.

28 - Endorsement of the professional liability insurance policy.

29 - A comparative table between the bylaws, articles of association or articles of incorporation amended in the act whose approval is sought and the last one previously submitted to Susep.

30 - A complete copy of the newspapers containing the publication of the notice or announcement convening the meeting, in accordance with the law, or proof of the convening of the meeting of the board of directors, deliberative board or controlling board.

31 - List of shareholders, associates or counsellors present at the act, with a declaration that, in the case of those represented, the determinations established in art. 126 of Law no. 6.404 of 1976 have been observed.

32 - A complete list of shareholders, associates or board members on the date of the act. In the case of shareholders, those who hold 15% (fifteen per cent) or more of the share capital must be informed, totalling the number of shares representing the share capital, with the expression "other shareholders" for those with a holding of less than 15% (fifteen per cent).

33 - Declaration that the legal provisions regarding the quorum for the installation and deliberation of the assembly or meeting held have been faithfully observed.

34 - A current professional liability insurance policy, accompanied by the formalities referred to in article 11, if contracted abroad.

ANNEX IV

DOCUMENTATION APPLICABLE TO ELECTION, APPOINTMENT, WITHDRAWAL AND RESIGNATION PROCEDURES

1 - An application addressed to the General Coordination responsible for licensing, accreditation, registration and authorisation, containing a list of the attached documents, signed by directors of the supervised company or of the reinsurance broker whose representativeness is recognised by the bylaws, or by the foreign reinsurer's attorney-in-fact or representative.

2 - A complete copy of the newspapers containing the publication of notice or announcement convening the general meeting, in accordance with the law, or proof of the convening of the meeting of the board of directors, deliberative board or controlling board.

3 - Minutes of the general meeting or meeting of the board of directors, deliberative or controlling board or articles of association, accompanied by the terms of office of those elected.

4 - Proof of appointment of the legal representative of a subsidiary in the country of a supervised company with its parent company abroad, legalised by a Brazilian consulate.

5 - Translation, by a sworn public translator, of the document referred to in item 4 above, registered at the relevant registry office.

6 - Declaration of compliance with the requirements set out in art. 44 of CNSP Resolution 422 of 2021 or any other rule that may replace it, signed both by the elected or nominated person, in accordance with the model published by Susep, and by the supervised companies, reinsurance brokers and representative offices of the admitted reinsurers, who must declare that they have carried out research on the nominee in public and private registration and information systems, taking responsibility for the veracity of the information they provide.

7 - Authorisation from Susep, signed by the elected or appointed person, to access information about them contained in any public or private registration and information system, including judicial or administrative processes and procedures, for exclusive use in the respective authorisation process, in accordance with the model published by Susep.

8 - A justified statement signed by the supervised company, the reinsurance broker or the representative of the admitted reinsurer's representative office that the person elected or appointed fulfils the technical training requirement set out in art. 45 of CNSP Resolution 422 of 2021 or any other rule that may replace it.

9 - Declaration signed by the supervised company that the person elected or appointed to the position of member of the audit committee referred to in par. 2 of art. 127 of CNSP Resolution 432, of 11 November 2021, or any other regulation that may replace it in dealing with the issue, has proven knowledge in the areas of accounting and auditing that qualifies them for the position, in accordance with the model published by Susep.

10 - Statement of corporate acts under consideration by Susep.

11 - A list of the members of the amended statutory or contractual body, before and after the act, containing the term of office and, in the case of the executive board, the specific functions before Susep.

12 - Registration form, according to the model published by Susep.

13 - Declaration, signed by the supervised company or the reinsurance broker, that the legal provisions regarding the quorum for the installation and resolution of the assembly or meeting held have been faithfully observed.

14 - Declaration, signed by the supervised company, that there is no kinship, up to the third degree, between directors and members of the supervisory board, as well as that the members of the supervisory board are not employees of the company.

15 - List of shareholders, associates or counsellors present at the act, with a declaration that, in the case of those represented, the determinations established in art. 126 of Law no. 6.404 of 1976 have been observed.

16 - A complete list of shareholders, controlling members or board members on the date the act was carried out. In the case of shareholders, those who hold 15% (fifteen per cent) or more of the share capital must be informed, totalling the number of shares representing the share capital, with the expression "other shareholders" for those with a holding of less than 15% (fifteen per cent).

17 - Act of deliberation of the parent company appointing the representative(s), with notarisation of the signatures of the directors and the veracity of the document, and legalised by a Brazilian consulate.

18 - Translation, carried out by a sworn public translator in Brazil, of the document referred to in item 17.

19 - Draft of the amendment to the articles of association, expressly mentioning which directors of the company will act as representatives and their substitutes.

20 - Amendments to articles of association or minutes of members' meetings.

21 - Amendment of the memorandum of association in the case of a sole proprietorship limited company.

22 - Letter of resignation or term of withdrawal.

23 - Declaration signed by the nominee, justifying the exemption referred to in par. 2 of art. 43 of CNSP Resolution no. 422 of 2021, with information on which company they were a director of and which position they previously held.

24 - Power of attorney referred to in art. 48 of CNSP Resolution no. 422 of 2021.

ANNEX V

DOCUMENTATION APPLICABLE TO REGULATORY SANDBOX PROCESSES

1 - Business plan, in accordance with art. 61.

2 - The applicant company's financial statements for the last two financial years, audited by an independent auditor duly registered with the CVM.

3 - List of shareholders, associates or counsellors present at the act, with a declaration that, in the case of those represented, the determinations established in art. 126 of Law no. 6,404 of 1976 have been observed.

4 - A full list of shareholders, associates or board members on the date of the act. In the case of shareholders, those who hold 15% (fifteen per cent) or more of the share capital must be informed, totalling the number of shares representing the share capital, with the expression "other shareholders" for those with a holding of less than 15% (fifteen per cent).

5 - Proof of invitation to the conclave, in accordance with the law.

6 - Minutes of the conclave.

7 - Declaration that the legal provisions regarding the quorum for the installation and deliberation of the assembly or meeting held have been faithfully observed.

8 - Last amendment to the articles of association.

The information provided in this publication is general and may not apply to a specific situation or person. Every effort has been made to ensure that matters of concern to readers are covered. Although the information provided is accurate, be advised that this is a developing area. The information contained herein is not intended to be relied upon or to be a substitute for legal advice in relation to particular circumstances. Specific legal advice should always be sought from experienced local advisers. Accordingly, Editora Roncarati accepts no liability for any loss that may arise from reliance upon this publication or the information it contains.